Case Study: Value Creation in Media Streaming

Music and video streaming sound similar, but are completely different in how the businesses are run and how the value is created for users.

Last two decades saw a rapid transition from physical media (CDs, DVDs) to digital media (MP3s, MP4s) to streaming (Spotify, Netflix). I thought that the streaming business model makes for a really good example for the value-led growth framework I was writing about previously.

Disclaimer: while I did some research for this article, most of it is an extrapolation of my own observations and experiences and will likely sound utterly wrong to someone on the inside. This is meant to be a useful exploration of how to approach new business models in the value creation framework and not meant to be a credible overview of the industry.

The next table shows how I would look at the streaming model from a very high level.

However the way it plays out is very different between music and video, so let’s take them one at a time.

Music streaming

Biggest names in music streaming are Spotify and Apple Music. Next are Amazon music and Tencent music and then a slew of others, but I’ll focus on the first two as they are so dominant.

I’ll also ignore alternatives like SoundCloud for this article, but may return to the topic later as it adds quite a lot of interesting dimensions to the analysis.

Music streaming is an example of competing mostly on soft value proposition. Chiefly this is due to the fact that the major labels have licensed content to all the major platforms.

I would guess that the reason for that were the bitter experiences with Apple iTunes exclusivities and the wish to make sure that the market is competitive enough so no one player has too much negotiation leverage.

Hard value proposition

Music content value is distributed very unevenly, with top artists commanding a large part of the market and the long tail collecting peanuts. But with same content available on all platforms this matters little.

Price, of course, is a major lever in consumer decision making. Apple's early strategy has been all about undercutting Spotify on pricing. E.g. Family pricing was lower with Apple for a long time as was individual for a shorter period. The importance of pricing is very easy to see as currently platforms are almost fully matched on price — if there would be a significant difference in value creation, it would result in a significant price difference as well.

On top of that Apple bundles Music with a bunch of other services as Apple One, which may still give them a significant pricing advantage on the aggregate.

Spotify on the other hand has an advantage on the ad-sponsored tier, which helps them hold on to price sensitive users until they can afford a Premium subscription. It also may provide a safety net for the same users in knowledge that they’ll still have access should their subscription lapse.

Both leverage campaigns and promotions as discussed in my article on pricing.

Soft value proposition

In early days of streaming delivering a smooth stream has been a challenge, but by now the network and the infrastructure has caught up and it’s pretty much even among the different players.

Discovering content is of course a massive challenges in the catalogue of 10s of millions of songs. It helps that most of the activity is concentrated in the head of that catalogue, but we are still talking about 10s and 100s of thousands of popular songs at anytime.

Both platforms have invested heavily in discovery:

Both have home screens with varying categories and ability to look by category

Search is top notch with high relevance and some fuzziness to highlight interesting results

Platform and user-generated playlists help surface and save relevant content

It’s quite interesting to make a guess how the user activity splits between various discovery modes, but with no knowledge of the industry whatsoever, I’d guess that majority who look for anything outside their own library would hit search, so that’s the main entry point.

Speaking of your own library, personalisation is huge in music streaming:

Personal library with albums, songs, artists and playlists

Personalised discovery, with your home screen and search influenced by your activity

Personal recommendations and magic playlists that build on your past preferences

This is where a lot of effort is being spent, as with other things equal it’s a huge driver of user value. Not only do you have to migrate your library, but the other platform discovery engine will seem inferior, as it doesn’t have the history to deliver personalised results.

However let’s also not over-blow the value here — while it does create a significant switching cost, it can be overcome with a campaign or price difference, and is the major reason why Apple offered 3 and 6 months free trials historically.

Overall we see a tightly competitive market with mostly even hard value proposition and close to even soft value proposition, with both demand and supply controlled by a few large players, who are vying to divide up the profit pools. There doesn’t seem to be a significant opportunity for disruption and the cost of playing for a significant market share is very high, as it’s almost impossible to differentiate without giving up on price and thus on profitability.

Video streaming

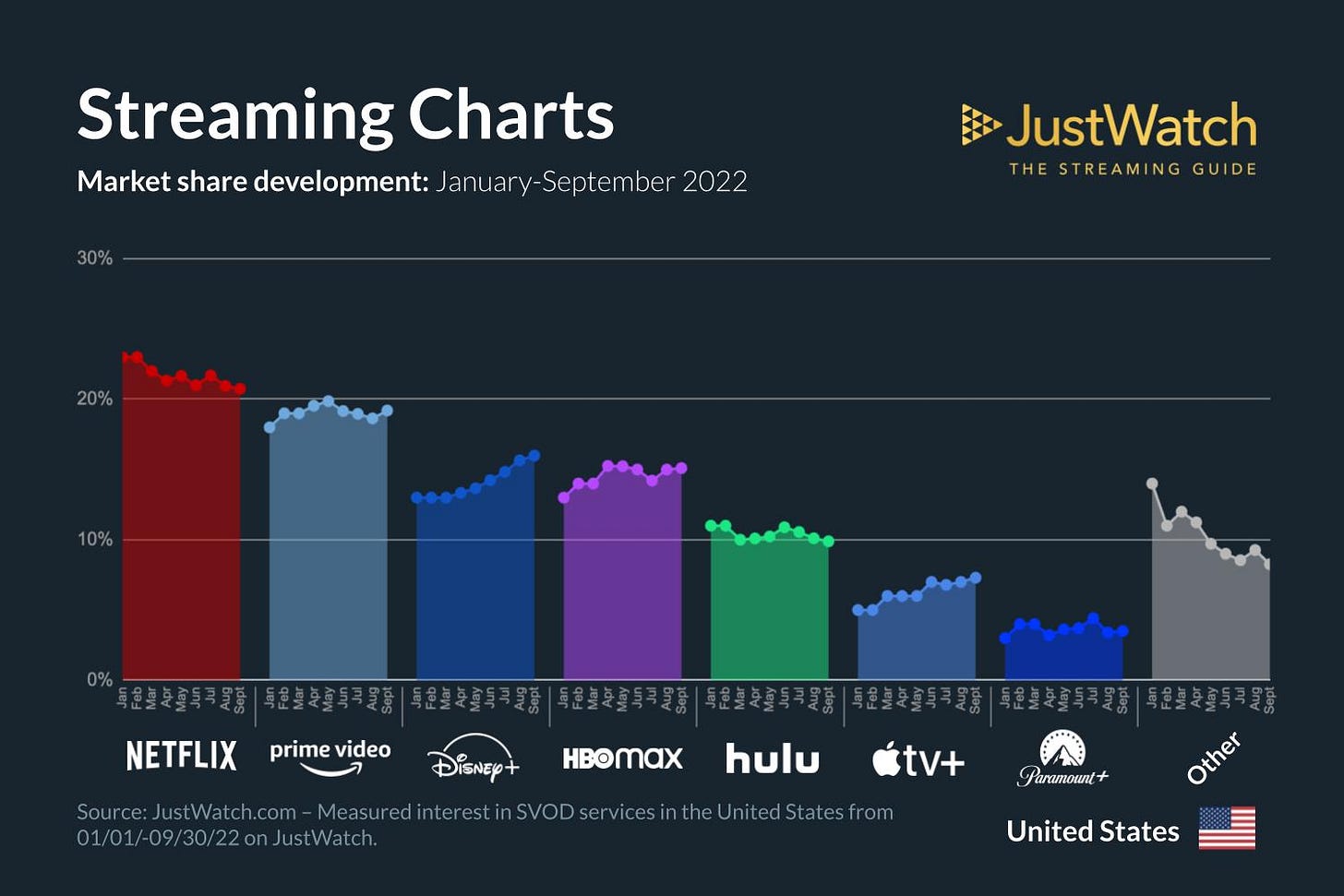

Major players in professional video content streaming include Netflix, Amazon Prime Video, HBO Max, Hulu, Disney+, Apple TV+, and a few others. The sheer number of viable competitor should tell you that the dynamic is quite different from music.

On top of that, the two top video streaming platforms by minutes watched are actually YouTube and TikTok, though since they are ad-supported the revenue is likely comparable with top pro content streamers. I will ignore them in this article for simplicity. Also Chinese platforms like Tencent Video are huge, but I’ll ignore them because I don’t know the dynamic there and am too lazy to do deep research.

Video is opposite of music, where content and pricing are heavily differentiated and soft value proposition matters little.

Hard value proposition

In video, content is king. Even on the user-generated platforms like YouTube top producers have exclusive or restrictive contracts in return for various preferential treatment. In the professional content streaming, the name of the game has been exclusive content since Netflix has released its first original — House of Cards in 2013.

Of course video content is far from uniform:

Uniqueness is the name of the game in the market — having a critical mass of attractive unique content is what attracts and retains subscribers and the only way to guarantee long term uniqueness is exclusivity

Volume of content is important to maximise the user-minutes viewed and increase pricing

Quality of course also matters, though it is quite subjective and can vary a great deal between different tiers of content

Variety of content is important to attract customers with differing interests, one size does not fit all

So volume, variety, quality and uniqueness of content all matter. On top of that to achieve a profitable business one likely need to view first tier exclusive and licensed content as loss leader, and make up the margin with cheaper licensed and produced second and third tier content. Note that again these are naïve guesses and just illustrate how I approach analysing business models through the lens of value creation.

This complexity and friction with profitability illustrate how difficult can managing hard value proposition be. From people at Netflix I heard that post 2014 the company essentially became a Hollywood studio with a tech department attached to it, focused on licensing and producing the right content as the top priority.

When looking at pricing we can see several factors:

Pricing matters a lot, platforms clearly compete heavily on pricing

Pricing is directly proportional to the size, quality and uniqueness of the catalogue

Pricing seems to be influenced by internal factors, like availability of capital

E.g. Apple has the smallest catalogue and the lowest price, that makes sense. But Prime Video has a comparable catalogue to Netflix, but is priced significantly lower. Disney+ has a lot of top quality content, but their catalogue is still tiny, underscoring the point that you need size to drive pricing. HBO Max leads on a lot of quality indicators and clearly has enough depth to driver premium pricing.

Prime Video is priced at the most bang for buck, since it’s not even a standalone service but is bundled with Prime Music and the Amazon Prime service overall. It’s unclear if Amazon is making any money on these businesses or treats them as loss leaders, but they certainly are a great value proposition for subscribers.

Since the price is so important, more and more platforms are embracing advertising to offset the costs and offer a better price to consumers. Hulu pioneered it, but now HBO Max, Paramount+ and Peacock all have an ad-supported tier and Netflix announced their intention to do so as well. An interesting dynamic will be the pricing and profitability of the the ad-supported tiers, as the best target users for advertising (highest earning bracket) are also the most likely to stay on Premium subscription, so will be interesting how much of the cost can actually be offset long-term.

There are also all kind of campaigns and bundling, with Apple especially aggressively tying its nascent TV+ service to hardware purchases and its Apple One subscription.

Soft value proposition

With heavy competition on the hard value proposition one would think that soft value proposition would matter little.

It definitely seems so on the Delivery side — Netflix did massive investments in technology and infrastructure and has by far the smoothest experience, with content playing immediately and skipping working smoothly almost never hitting buffering.

Amazon Prime and Disney+ buffer constantly for me, but since they have some great content I curse and wait, and I assume that most users do the same.

It seems the same on General UX side — Disney+ is constantly frustrating me by lacking basic features like skipping ahead, skipping titles or starting next episode, but I happily lap up Moon Knight and She-Hulk episodes finding the workaround in the process (skipping to the end of the episode starts the next one, yay!).

Discovery is more complex. As noted in music section, having the content isn’t enough, it needs to be found by users. Here Amazon Prime is particularly weak, it has a deep catalogue, but a really weak discovery, so it can be perceived to be very shallow. This is a great example how reality and perception might splinter and how bad UX can undermine great hard value proposition.

Disney+ is also weak on discovery, but has a much smaller catalogue so it’s less of an issue.

Personalisation is quite important to help discovery, but much less so than in music streaming. There is no real user library and no user-generated content. Recommendations and search relevance are important, but since the amount of content is not as large, it’s an optimisation, not a differentiator.

Overall soft value proposition shouldn’t matter too much, when such heavy competition is happening in content and pricing.

However, subjectively, in Prime Video it might be a real factor driving pricing down. Between the horrible discovery, bad delivery, missing personalisation and bad UX overall, it’s the service that is truly unpleasant for me to use, and I assume there are many others who feel the same. I still pay for it, since it’s included in Amazon Prime, but I do assume that its value is heavily compressed by bad soft value proposition.

Conclusion

I think it’s remarkable that from a similar start Music and Video media streaming has diverged so heavily. 8 years ago Netflix was king and launched it first ever original content, which was then largely seen as an experiment. At about the same time Kanye West, Beyonce, Jay-Z and Taylor Swift were launching exclusives with music services.

Today music streaming is dominated by a few of companies with low differentiation and tight competition, while video streaming has seen Netflix dethroned and focuses on content differentiation above all.

It’s likely that the different dynamic is driven by different content structure.

In music it’s dominated by a few major labels, which are interested in retaining their leverage. For whatever reason, those labels also decided against launching their own streaming services (not gonna guess why, but it would have been terrible for users), so more or less same content is carried by the platforms.

In Video content licensing and production is very fragmented with major and minor players competing with each other. Tech companies have built out content departments (Apple, Amazon) and content companies have built streaming services (HBO Max, Disney+, Paramount+, Peacock).

On top of that there are both independent streaming players (Netflix, Spotify) and parts of the conglomerates (Apple, Amazon). The latter are big players in both worlds and have integrated subscriptions covering all products. Unfortunately, since the video world is so fragmented, those subscriptions are quite far from covering all their user needs.

It’s an exciting and very competitive world and there is a lot to learn from trying to structure and analyse it.